Tax Information

Where does Hitech2Business operate from?

All purchases made on Hitech2Business are subject to the company Myjaam OU and are subject to current Estonian and EU regulations, as well as all other legal provisions affecting international transactions. The purchasing system is subject to current Estonian legislation.

Do Hitech2Business prices include VAT or other taxes?

No, the taxes included in all transactions carried out by Hitech2Business or the company Myjaam OU are 0%.

Hitech2Business sells in regions exempt from VAT (Value Added Tax), and therefore all advertised prices do not include it. We understand that our customers are always exclusively businesses, and therefore this is considered a B2B transaction.

This applies to both purchases made on our platform and purchases made by end-customers on external platforms, such as marketplaces or large platforms with which our company collaborates.

VAT will be added by marketplaces, large platforms, small business merchants, or any company that collaborates with our company, depending on the applicable country and the applicable country, based on the criteria for subsequent marketing. Our company never collects VAT from individual end customers, nor does it deposit it with the authorities.

What VAT will be applied if I place an order to a different country?

Currently, on Hitech2Business and on external collaboration platforms, orders are always invoiced with 0% VAT if the VAT number is valid in VIES. If the collaborating company does not have a VAT number registered in VIES, our company will not allow the transaction.

TRANSACTIONS BETWEEN COUNTRIES WITHIN THE EUROPEAN UNION

Do companies from European Union countries have to pay VAT on their purchases?

As Hitech2Business is a purely intermediary company, which does not have its own warehouse, does not hold products, nor does it carry out shipments or physical distribution of products.

It always operates through an intra-community triangular system, and the company from which the invoice is issued has an intra-community VAT number. All purchases made by companies based in any European Union country with a VAT number will be exempt from paying VAT. It is essential that our system validates the VAT number on the VIES platform.

Do companies from European Union countries with a VAT number have to pay VAT if the goods are delivered to a specific country within the European Union?

No. Our company collaborates with various official suppliers, all of whom have warehouses in different countries within the European Union and all of whom have a European VAT number registered with VIES.

This allows all shipments to be made by suppliers from a different country than our company's, and also from the company that purchases on our platform or collaborates with us.

As this is an intra-community triangular transaction between companies located in three different European Union countries, all transactions will always be exempt from VAT.

If you use Hitech2Business services externally through e-commerce, a marketplace, social media, or any other sales channel, who is responsible for managing the VAT for end customers?

Our company only conducts B2B transactions with business clients who have an active intra-community VAT number registered in the European Union in the VIES.

Therefore, if you integrate the products on our platform and begin using our services, whether in your marketplace, your e-commerce platform, other platforms, social networks, or any other sales channel, your company will be responsible for managing the VAT corresponding to the location of your end customers.

The use of any of our services implies your acceptance of these VAT terms and conditions and all the terms and conditions expressed on our website.

Our company will not operate under the terms and conditions of your platform or marketplace, nor will it assume them, nor will it sign its acceptance or any user agreement in this regard. Only the terms and conditions of our platform will be acceptable.

You can access the full terms and conditions of use for our platform at the following link:

https://hitech2business.com/policies/terms-of-service

Trending

View all-

Apple

Apple iPhone 15 (128 GB) - Azul

€581,49 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

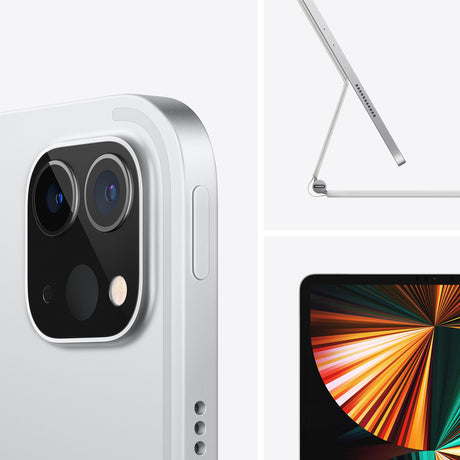

2021 Apple iPad Pro (de 11 Pulgadas, con Wi-Fi, 2 TB) - Gris Espacial (3.ª generación)

€1.900,99 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.898,87 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€0,00 VAT ExemptUnit price VAT Exempt /Unavailable -

Apple

Smartphone Apple iPhone 14 Pro Plateado 512 GB 6,1"

€1.371,91 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.077,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€869,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.618,89 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.275,12 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.300,64 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.345,89 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.000,95 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€883,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.148,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€344,89 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.278,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.472,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€1.244,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€344,89 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€840,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€869,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€857,00 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€818,09 VAT ExemptUnit price VAT Exempt /UnavailableIn stock -

Apple

€772,59 VAT ExemptUnit price VAT Exempt /UnavailableIn stock